Crude-laden VLCCs moving at slowest pace in over three years

Crude-laden VLCCs, which carry over half of global waterborne crude, are moving slower than they have in more than three years.

Market and Trading Calls:

- Bearish crude timespreads as a lengthening global balance weighs on structure.

- Bullish onshore and offshore crude inventories as robust crude exports and oil on water signal a growing global excess.

In October, the average speed of loaded VLCCs has dropped below 9 knots — the first time this threshold has been breached since July 2022. In tanker markets, speed is signal. Slowing vessels typically indicate a deliberate delay - either because the cargo is not yet needed, or worse, because the seller has no firm buyer lined up.

Average speed of crude-laden VLCCs, knots

Source: Kpler

At the same time, global crude exports remain elevated. September saw exports jump 3.6 Mbd month-on-month to the highest monthly pace on our records. October’s pace is already one of the highest months on our records and will only rise further as post-month-end reclassifications take effect, particularly Brazilian barrels from FPSOs that initially appear as domestic flows but flip to exports, and dark vessel activity captured by satellite imagery.

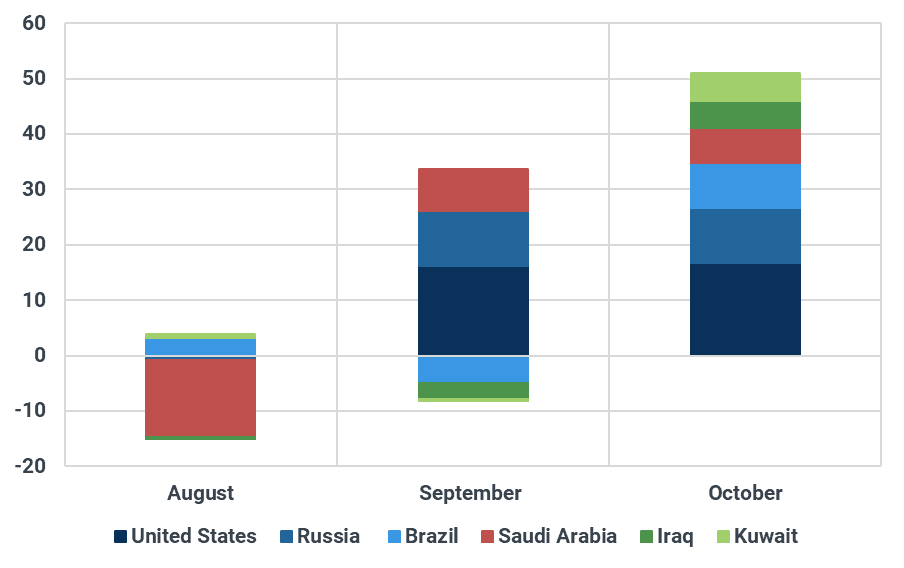

This powerful combination of rising exports and decelerating tanker speeds is feeding a growing glut of oil on the water. The US, Russia, and Saudi Arabia accounted for three-quarters of the rise in oil on water in September amid stronger exports (while Brazilian oil on water dropped due to lower exports, and flows to China did not ramp up until late in the month). Oil on water has been climbing again in October, with Brazil, Iraq, and Kuwait also adding to long-haul volumes. These six account for about two-thirds of the rise in oil on water this month.

Yet it is not just about volume; it is about velocity. The market is receiving a clear behavioural signal: VLCCs are deliberately slow-steaming to extend delivery windows. This behaviour rarely appears in tight or balanced markets. It typically suggests either a lack of buyer demand or an attempt to manage timing around saturated terminals.

This dynamic heightens the risk of floating storage buildup, especially if Asian importers are unable to absorb incoming flows. The Atlantic-to-East route is particularly exposed, and slower voyage completion could exacerbate weakness in physical differentials into year-end. In short, the market is long and getting longer - and it is visible not only in oil on water, but also in vessel behaviour.

Month-on-month change in oil on water by origin country, Mbbls

Source: Kpler

See why the most successful traders and shipping experts use Kpler