The EU clarifies on the 18th sanctions package: Reliance to gain, STAR to lose

The European Commission’s recent clarification on its 18th sanctions package against Russia introduces much-needed operational clarity for refiners processing Russian crude outside the bloc. The key message: no Russian-origin product can re-enter the EU, but exceptions apply if refiners follow a strict segregation or refinery washout process.

Market & Trading Calls

- Optimistic on the resilience of Russian crude flows to India as the EU clarification paves the way for Reliance to continue Russian crude imports and European product exports.

- Turkey's imports of Russian crude likely to be reshuffled between Socar and Tupras. Flows to Socar's STAR refinery are more at risk as the refinery will want to keep its EU market access; Tupras faces logistical and political challenges.

- Bearish Dubai structure as Reliance's demand for Russian crude will stay robust, with minor gains for alternative Middle Eastern grades on the cards.

As highlighted last week, two core compliance pathways are outlined:

- Segregated processing: Products exported to the EU must be demonstrably derived from non-Russian crude. This requires physical separation at the CDU level.

- 60-day washout: No Russian crude processed or imported at the facility for 60 days prior to the bill of lading date for EU-bound product cargoes.

The regulation includes carve-outs for five “partner” nations (US, UK, Canada, Switzerland, Norway) and four “net exporters” (Saudi Arabia, Iraq, UAE, Nigeria). However, this list is dynamic. Should any of these become major conduits for Russian-origin flows, exemptions may be revoked.

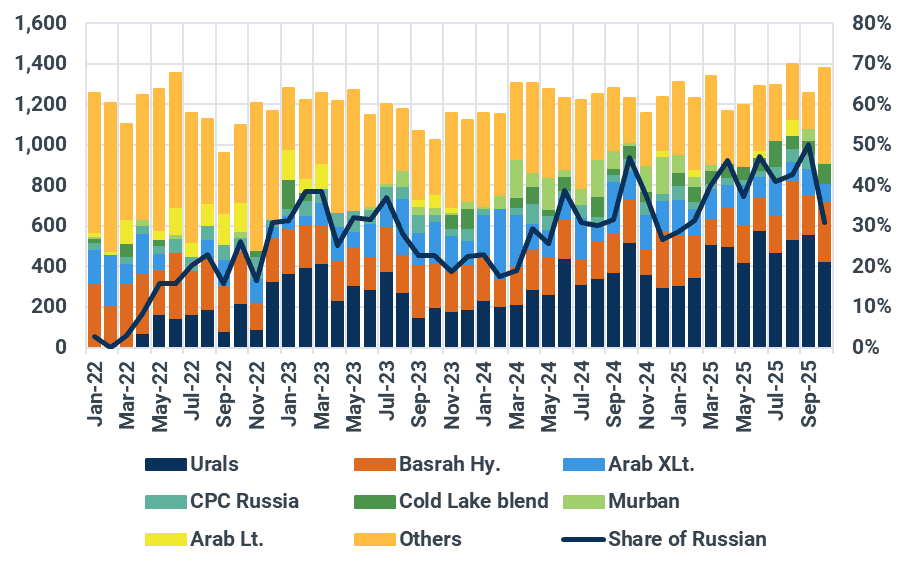

Reliance Industries emerges as a potential winner. Its Jamnagar complex—operating almost 1.5 Mbd across four CDUs—is structurally capable of isolating Russian oil (half of its crude imports) and non-Russian streams. The company, averaging 179 kbd in product exports to the EU YTD and ranking second behind KPC, saw its stock rally 6.6% across two sessions post-clarification. The EU represents 21% of its export market ytd, making it an important stream to preserve. This supports a continued two-way arbitrage: Russian crude in, refined products out, sustaining Europe’s supply chain while preserving Indian strategic sourcing flexibility.

Reliance's Jamnagar oil imports by grades (kbd, LHS) and share of Russian crude (%, RHS)

Source: Kpler

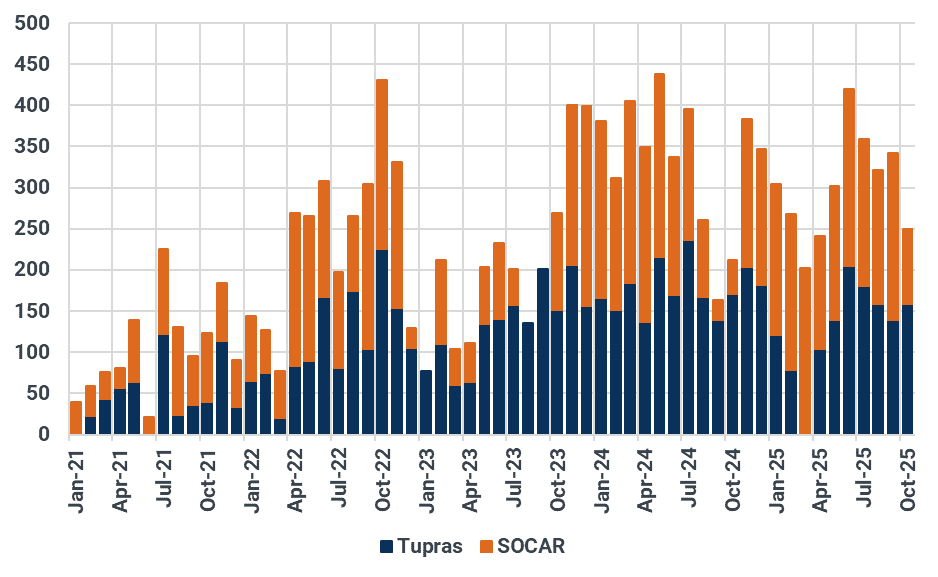

The outlook is less favourable for Turkish refiners. SOCAR’s STAR refinery, with a single 214 kbd CDU and strong EU exposure, cannot comply with segregation requirements and will likely need to halt Russian crude imports if it wishes to maintain EU product exports. The EU represents a share of 73% (or 85 kbd) of its products exports. Turkish refiners have started diversifying from Russian crude. Beyond the resumption of Kirkuk oil flows to Turkey (to Tupras), a cargo of Angola's medium sour Mostarda grade is currently en route to Aliaga for the first time ever, possibly to Tupras Aliaga or to Socar's STAR refinery.

Tupras faces a more nuanced challenge. Its Aliaga (150 kbd + 90 kbd) and Izmit (100 kbd + 85 kbd + 41 kbd) refineries imported 53 kbd and 74 kbd of Russian crude, respectively ytd. In theory, Tupras could allocate one CDU at each site to Russian-only crude and others to compliant barrels, maintaining some EU market share. But execution will require logistical precision and political backing.

Turkey oil imports from Russia by buyer, kbd

Source: Kpler

President Erdogan’s balancing act will be key. Continued high Russian crude intake could strengthen Ankara’s hand in diplomacy with Moscow and Brussels. However, restructuring Turkish refinery runs under these constraints will require both capital and alignment across political and corporate actors.

In the near term, these developments point to marginal reductions in Turkish intake of Russian crude and stable-to-mildly-declining flows into India, with Dubai timespreads likely to ease further amid robust Russian medium sour supply in India.

Market insights you can trust

Kpler delivers unbiased, expert-driven intelligence that helps you stay ahead of supply, demand, and market shifts.

Trade smarter. Request access to Kpler today.

See why the most successful traders and shipping experts use Kpler