ICE confirms EU sanctions implementation rules in gasoil contract

ICE has confirmed new rules for the implementation of EU sanctions that would ban oil products derived from Russian crude from January 21 2026 in its physically delivered gasoil futures contracts, going further than the EU in one especially important instance.

Key takeaways

- ICE formally changes to rules: ULSD derived from Russian crude formally prohibited from contract following EU sanctions coming into force on 21 January 2026.

- 60-day Russian crude washout adopted: only diesel where it is proven that the refinery has not received a Russian crude cargo in the 60 days prior to BL will be acceptable. EU partner countries are exempt and cargoes from countries that are net exporters of crude must have a Certificate of Origin.

- ICE goes further than EU: a lack of clarity around what “enhanced due diligence” entails in the EU guidelines sees ICE step in to apply a strict port level washout requirement on segregated refineries, putting Jamnagar barrels in doubt for delivery.

- Full traceability required: commingled or co-loaded product is not acceptable unless its provenance is fully accounted for. Full traceability throughout the chain if seller sources from a third-party.

The Intercontinental Exchange (ICE) has confirmed in a circular new rules regarding the implementation of EU sanctions on the import of oil products derived from Russian crude. These will mostly follow the guidance set out by the EU last month and builds upon the exchange’s initial proposals set out in October.

The full traceability of product loaded from a shared facility remains in place as does the EU exemptions for the countries who are net exporters of crude and partner countries of the EU (Canada, Norway, USA, UK, Switzerland, Australia, Japan, New Zealand), with proof of the product’s origin required.

However, the key difference between the EU’s guidelines and ICE’s new rules is that it goes much further into addressing how to implement the EU’s “enhanced due diligence” for product from refineries in designated third-countries – i.e. not an EU partner country (see below) and not a net exporter of crude, but rather a country such as India or Turkey.

Specifically, it concerns how to treat product from a refinery that is effectively split into two as regards processing; with one facility running Russian crude and the other not. In response to the lack of guidance, ICE looks to have erred on the side of caution, mandating that: “[w]here a port of discharge serves more than one refinery that port, rather than any particular tanks therein, shall be regarded as a single installation.” This would leave the facility subject to a 60-day washout period in order for the diesel to be eligible for the delivery mechanism.

This scenario would seem to affect Reliance’s Jamnagar refinery, which has both a domestic refinery and export refinery supplied via the same port. Diesel exports would consequently be ineligible for delivery unless both facilities had not received Russian crude in the 60 days prior to the bill of lading of the cargo. This is at odds with the initial reading of EU’s guidelines which appeared to create a carve-out via still onerous documentation and segregation requirements for the significant supplier of diesel to the EU (around 13 kbd so far this year).

The stricter and clearer rules generally conform with how ICE has treated the contract, with delivery subject to tighter tolerances than industry standards and punitive consequences for poor performance to preserve its integrity.

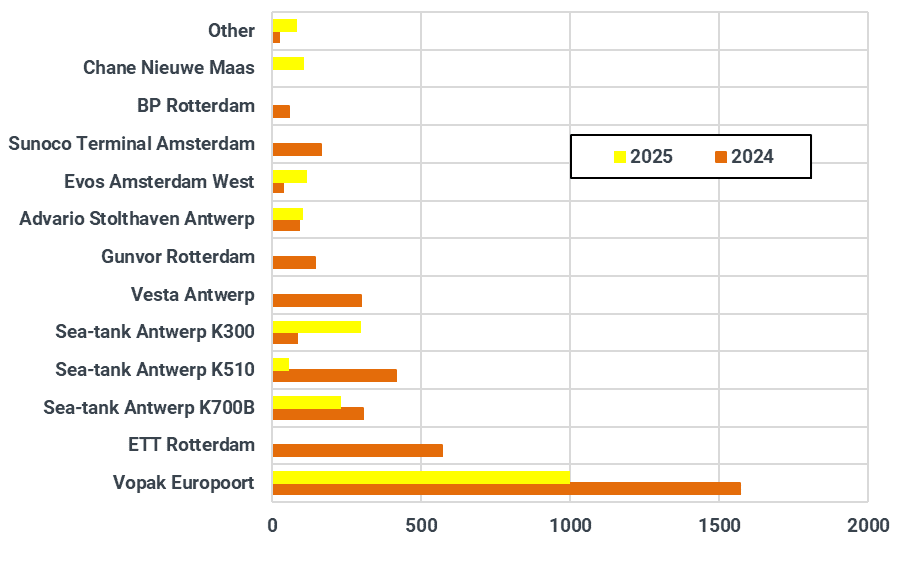

The net effect is perhaps limited in terms of quantity as while Jamnagar is a significant supplier to storages in Amsterdam, Rotterdam, Antwerp – the eligible FOB locations along with Flushing and Ghent, ICE gasoil physical deliveries are relatively small.

Belgium and Netherlands gasoil/diesel imports from Jamnagar by terminal (kt)

Source: Kpler

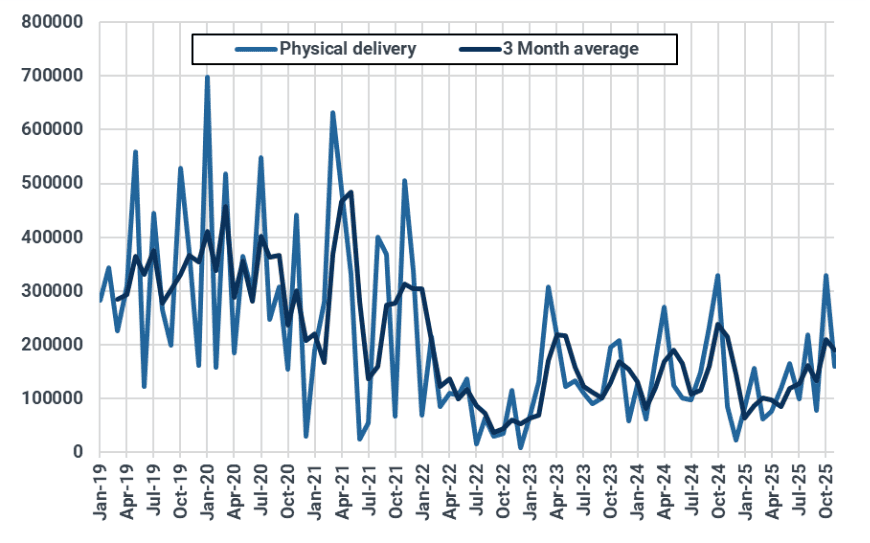

For the recently-expired November 2025 contract physical delivery was 160kt – and the mechanism exists alongside other venues including the Window and the brokered market where time will tell if this rule becomes the de facto market standard. However, it does remove some optionality which certainly has a cost, and it could also spur the EU to be more explicit as to its own guidelines on permissible product from segregated refineries. Indeed, the ICE circular notes that this rule is in place “until further guidance is given by the EU or an established market practice accepted by EU authorities emerges.”

ICE gasoil physical deliveries (t)

Source: ICE

Want market insights you can actually trust?

Kpler delivers unbiased, expert-driven intelligence that helps you stay ahead of supply, demand, and market shifts. Our precise forecasting empowers smarter trading and risk management decisions.

Unbiased. Data-driven. Essential. Request access to Kpler today.

See why the most successful traders and shipping experts use Kpler