Russian oil flows under sanctions: an update two weeks on

As Putin travels to New Delhi, oil trade will be ranked high in the list of hot topics. What does the latest data tell us two weeks after US sanctions on Rosneft and Lukoil became effective?

Key Takeaways

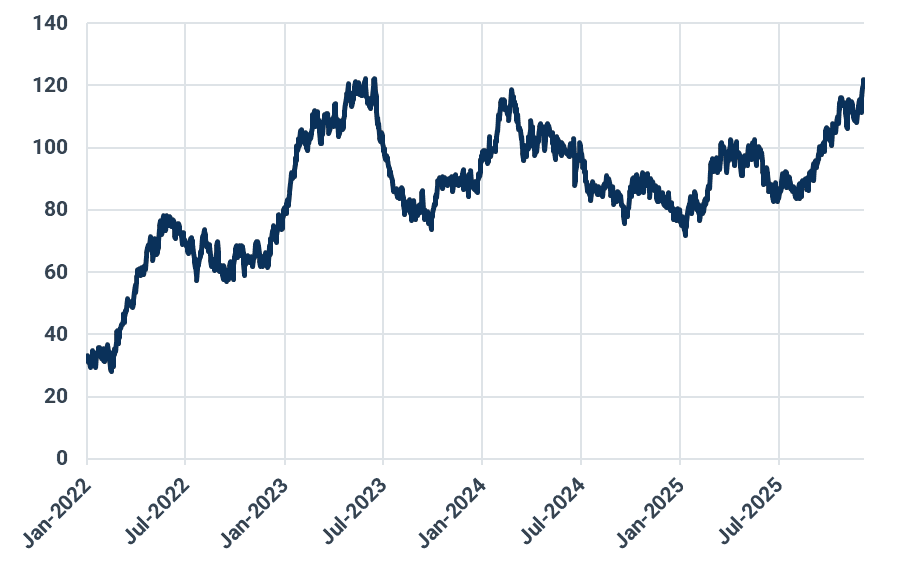

- ESPO weakens sharply: The differential to ICE Brent collapses from +$2/bbl pre-sanctions to more than -$6/bbl (Argus).

- India’s state refiners' strategies diverge: IOC and BPCL continue lifting Russian crude; MRPL and HPCL step back.

- Reliance's Russian crude import likely to decline: Our base case remains that Jamnagar will gradually wind down its intake of Russian crude, even though two cargoes were discharged last week. These recent arrivals do not necessarily signal a structural shift in buying patterns, and we still expect purchases to taper as refiners adjust to the evolving sanctions landscape.

- China teapots fill the gap: Seaborne Chinese imports drop to 1.1 Mbd, but quota allocation and lower pricing drive rising appetite.

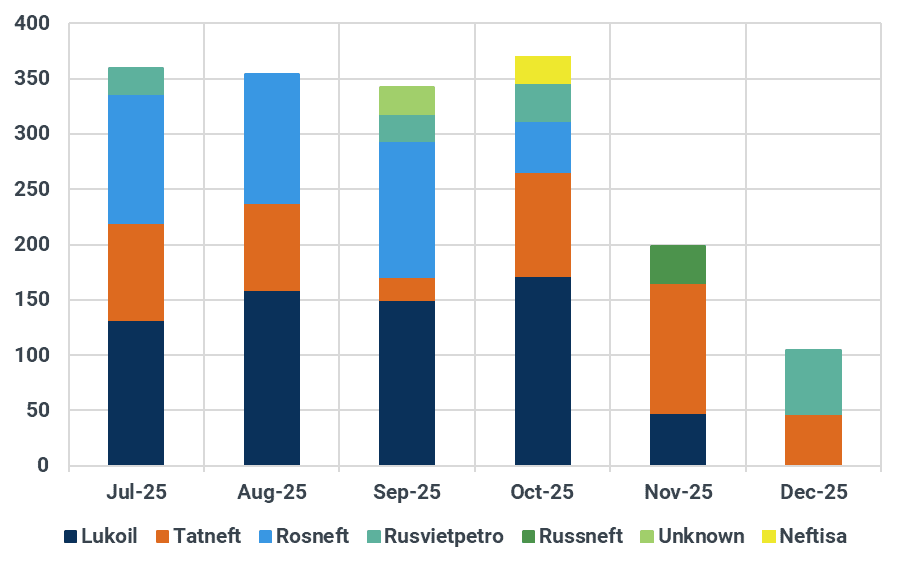

- Turkey pivots to alternative sellers: Tatneft and Rusvietpetro now sole suppliers, as volumes drop 70% since Oct.

- Floating storage draws down: Russian crude on water surges +12 Mbbls, but floating storage drops as tankers move towards the MED and Asia.

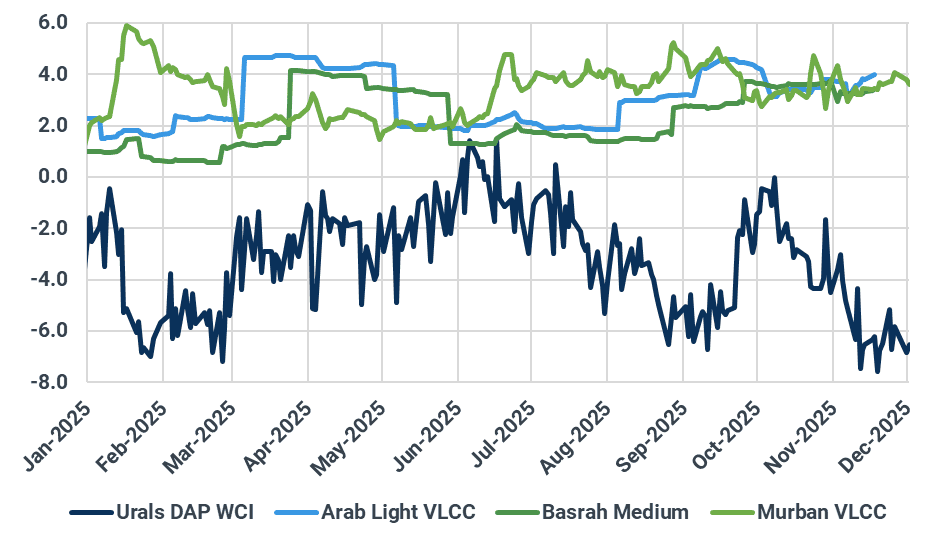

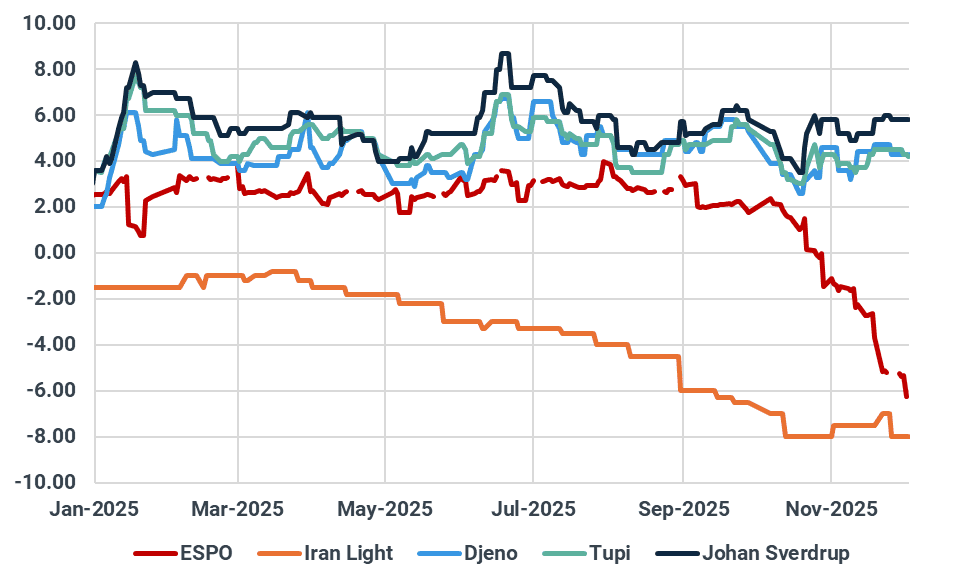

As expected, two weeks after the US sanctions on Rosneft and Lukoil came into effect, the physical market for Russian crude has begun to fracture, but not break. Brent has gained only 2% since the effective date, yet Russian differentials have widened significantly. ESPO crude has seen its premium to ICE Brent flip to a deep discount, moving from +$2/bbl in the 30 days pre-sanctions to -$6/bbl or more now, according to Argus data. Similarly, Urals delivered into India’s west coast now trades at a steady $6.50/bbl discount, compared to just $2/bbl prior to the sanctions.

Selected grades DES India against Oman/Dubai, $/bbl

Source: Kpler based on Argus Media data

Selected grades DES Shandong against ICE Brent, $/bbl

Source: Argus Media

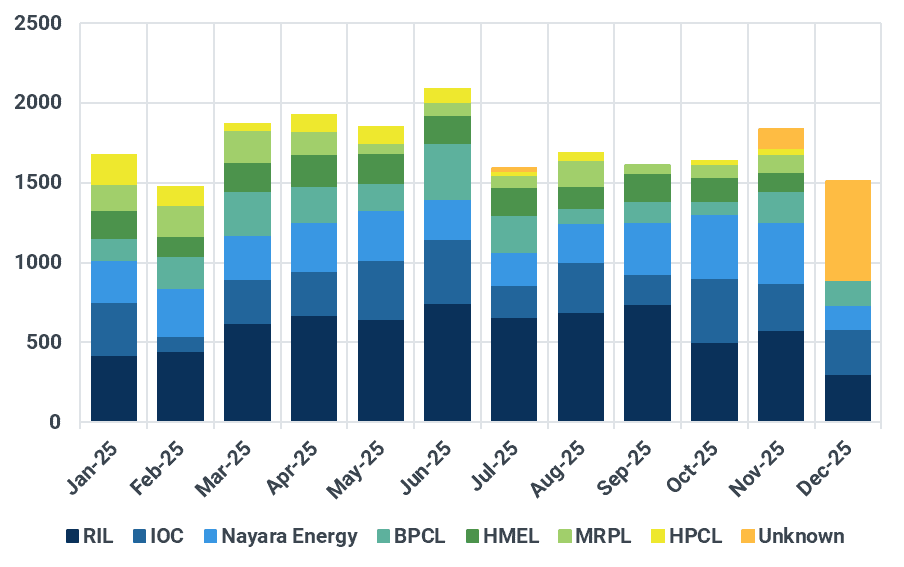

As President Putin arrived in New Delhi yesterday, PM Modi welcomed him on the airport runway, a rare event for a foreign leader in India. While this is an indication of how strategic the Russia-India relationship is to New Delhi, refining behavior is fragmented. MRPL and HPCL have reduced Russian crude liftings, but IOC and BPCL continue to import.

In the private sector, Nayara Energy, partly owned by Rosneft, remains anchored to Russian supply. Reliance’s imports of Russian crude may be entering new territory, even as the refinery continues to act as the key swing buyer. Two Russian cargoes discharged at its Jamnagar facility this week, the first since sanctions took effect. However, given the new ICE regulations, ongoing OFAC sanctions, and the broader pressure surrounding Russian crude imports, our base case remains that Jamnagar will gradually wind down its intake of Russian crude. India’s arrivals from Russia average 1.5 Mbd month-to-date, with predictive flows pointing to a potential rise to 1.6 Mbd. This remains below the 2024 average of 1.75 Mbd, but the decline is modest at ~250 kbd.

India’s oil imports from Russia by buyer, kbd

Source: Kpler

In China, state-owned players remain largely absent, aside from the steady 800 kbd flowing via pipeline. But teapots are stepping in. Following fresh import quota allocations totaling 7.4 Mt across 20+ private refiners, Russian seaborne flows averaged 1.1 Mbd in the last ten days, down from the Sep–Nov average of 1.27 Mbd, but with upward momentum likely: crude availability and aggressive discounts are pushing Shandong teapot refinery utilisation to 55%, the highest since Oct. 2024 (OilChem).

China’s seaborne oil imports from Russia, kbd

Source: Kpler

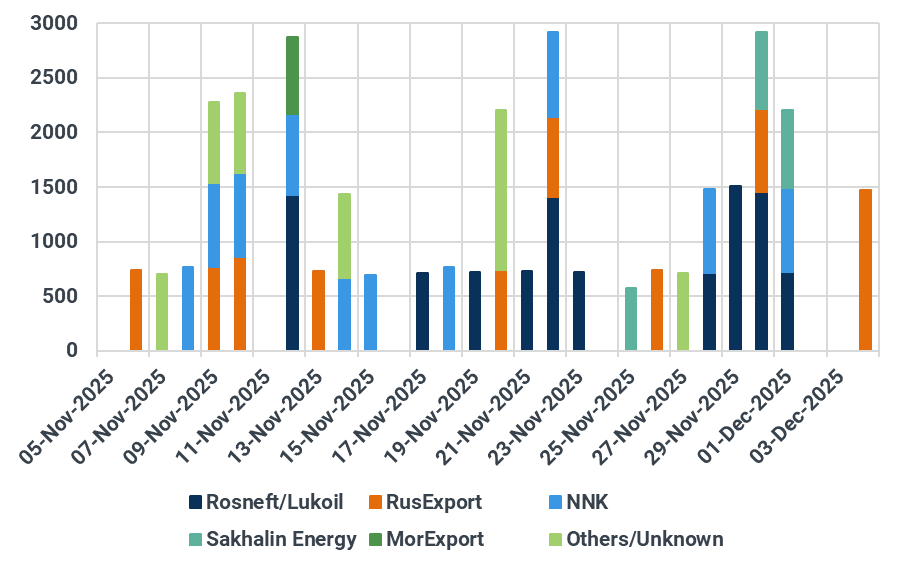

As highlighted a few weeks ago, Turkey offers the clearest view into how Russia is adapting. With STAR unable to separate origin post-refining, Russian barrels supplied by Rosneft and Lukoil are being avoided. Imports from Russia have dropped from 370 kbd in Oct. to 200 kbd in Nov., and are tracking just 100 kbd in Dec. None of the recent Turkish-bound volumes are from Rosneft or Lukoil—instead, Tatneft and Rusvietpetro are handling supply, suggesting Russia is strategically routing flows through non-sanctioned entities.

Turkey oil imports from Russia by sellers, kbd

Source: Kpler

Russian oil in floating storage has actually decreased since 21 November, as many floating cargoes have finally started moving towards the MED. The level of Russian crude on water has jumped by more than 12 Mbbls in the past two weeks, reaching its record level that it hadn’t reached since mid-2023.

Russian crude oil on water, Mbbls

Source: Kpler

Want market insights you can actually trust?

Kpler delivers unbiased, expert-driven intelligence that helps you stay ahead of supply, demand, and market shifts. Our precise forecasting empowers smarter trading and risk management decisions.

Unbiased. Data-driven. Essential. Request access to Kpler today.