Russian gasoline exports dry up, limited but welcome upside for European refiners

Amid a prolonged export ban and ongoing strikes on Russian refinery assets, September marks an unprecedented halt to Russian gasoline exports. For now, the upside for European refiners remains limited, but our flows data show some early indications of a modest pick-up in European outflows to some of the largest importers of Russian gasoline. Coupled with recent developments at Dangote, and depressed PADD 1 inventories, European exports look ripe for a rebound in the near term.

Market and Trading Calls:

- Russian seaborne gasoline exports to drop to zero in September for the first time since our records began.

- Upside for European refiners limited, as gasoline exports remain depressed on a seasonal basis, with September levels just marginally up from August.

- However, these dynamics hint at further potential upside for European outflows, as Russia's retreat from international markets creates more room for European barrels in Africa, at the same time as arbitrage economics into the US market improve.

Russian seaborne gasoline exports are set to drop to zero this month, for the first time since our records began. Amid a prolonged export ban to ease domestic market pressures and continued strikes on its energy infrastructure, Russian gasoline exports have fallen significantly this year, but Russia was able to retain limited market share among its main trading partners, Nigeria, the UAE, Libya, Brazil, Tunisia, Ghana, and Turkey.

With exports now coming to a halt, our flows data show a moderate uptick in European loadings to these destinations, contributing to the increase in total European gasoline exports in September, even if volumes remain remarkably low compared to previous years.

At the same time, European volumes bound to WAF and the US are set to re-enter the seasonal range for the first time in four months, as PADD 1 inventories fail to catch up with previous years while maintenance season in the US ramps up, helping to improve the transatlantic arbitrage on paper, and as problems at Dangote pile up. Indeed, on top of a halted RFCC unit, the Nigerian refinery is having to contend with hefty personnel losses and issues in selling to the local market, coinciding with the recent unwinding of European product in floating storage.

As the West African market tightens significantly over the coming weeks, and assuming Russia is unable to return to international markets for a while, these factors suggest European refiners could be in for a much-needed export rebound in the near term. A revival, both in traditional markets and via recapturing market share from typical Russian buyers, should inject some dynamism into the structurally weakening European export business in the near term.

US: Weekly PADD-1 gasoline inventories (Mbbls)

Source: EIA

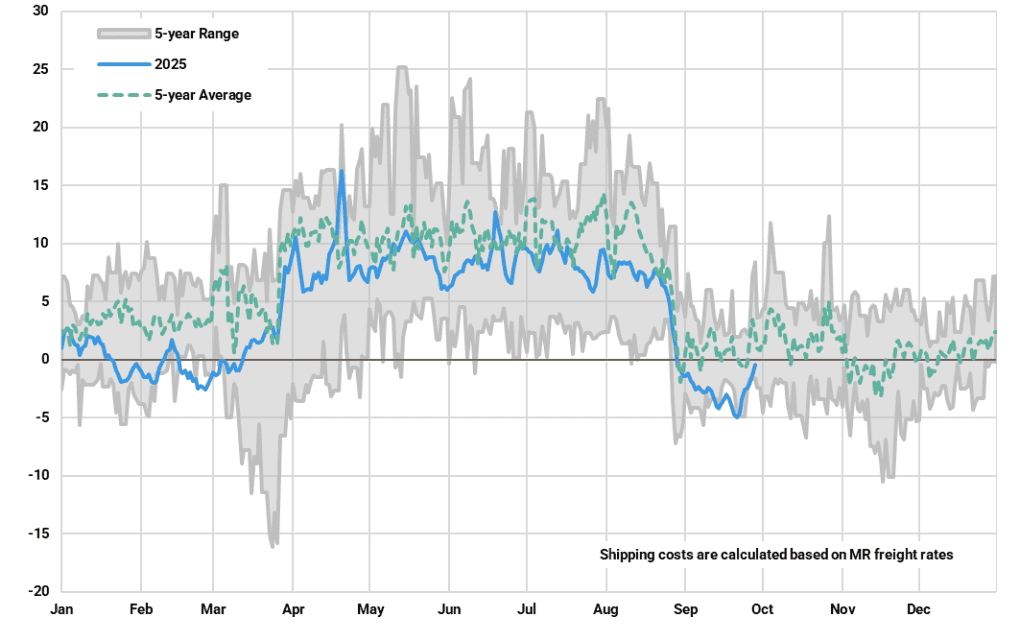

Freight adjusted arb incentive from NWE to US Atlantic Coast ($/bbl)

Sources: Kpler calculations using Argus Media pricing, McQuilling freight data

Market insights you can trust

Kpler delivers unbiased, expert-driven intelligence that helps you stay ahead of supply, demand, and market shifts.

Trade smarter. Request access to Kpler today.

See why the most successful traders and shipping experts use Kpler