Abandoning the price cap would expand the Shadow Fleet and reshape tanker markets

The EU is considering abandoning the price-cap mechanism designed to curb Russian oil revenues by restricting access to Western shipping services. Such a move would force roughly 43% of Russian oil exports to secure alternative vessels or, more likely, trigger increased sales of Western-owned ships and a shift in vessel coverage to smaller and less well-capitalized insurers.

Market & Trading Implications

- A full ban on Western shipping services would require substantial growth in the Shadow Fleet, an outcome that is both possible and probable.

- Russian freight rates would need to rise in order to attract more vessels into the trade.

- MRs face the largest replacement gap, with over 180 additional vessels needed.

- Suezmax and Aframax shadow fleets could also grow significantly.

Background on the Price Cap

The price caps were introduced progressively, starting in late 2022 for crude and early 2023 for refined products. They contributed to Russian barrels trading at a discount, although it remains unclear how much of that discount is due specifically to the cap.

Crucially, the policy’s most tangible effect has been the creation of a “Shadow Fleet”: tankers operating largely outside Western ownership and insurance, dedicated almost entirely to Russian oil exports.

Under the current rules, Western-owned or Western-insured ships may carry Russian oil only if the cargo is sold at or below the cap.

The proposal under discussion would eliminate this mechanism. Instead, Western shipowners, insurers, brokers, and other service providers would be barred from supporting any vessel carrying Russian crude or products, regardless of sales price.

Current Fleet Exposure

Our analysis identifies:

- 687 tankers with Western ownership and/or insurance that loaded at least one Russian oil cargo (crude, DPP, or CPP) in the last 12 months.

- An additional 587 tankers in the Shadow Fleet without Western ownership or insurance coverage or for which coverage data is unavailable.

While this appears large, vessel counts alone obscure the true importance of these ships to Russian exports.

To understand the real impact, we examined the four tanker classes that account for 95% of Russia’s 5.7 Mbd of liquid exports: Suezmax, Aframax, MR, and Handymax.

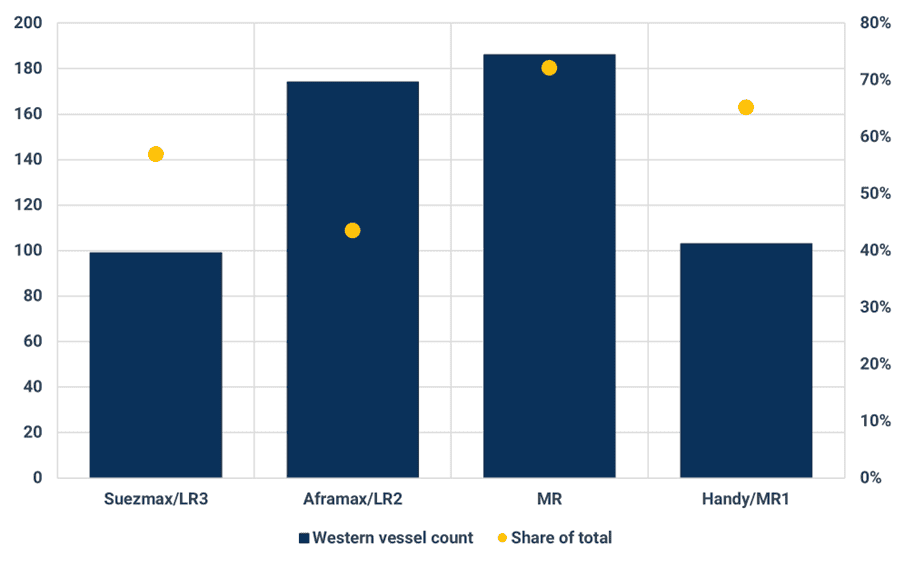

Count of Western tankers in the Russian market (Nov 24-Nov 25)

Source: Kpler

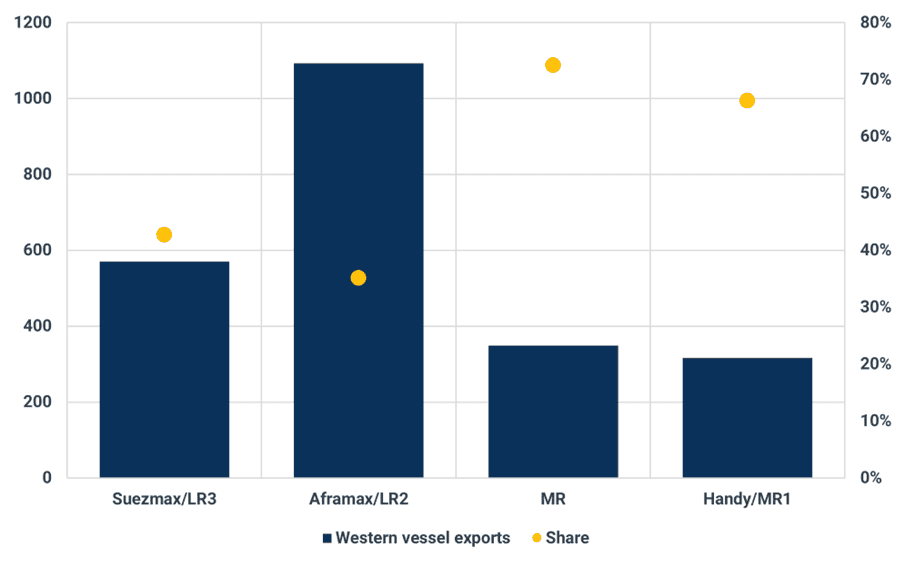

Exports on Western tankers in the Russian market (kbd) (Nov 24-Nov 25)

Source: Kpler

Western-covered vessels represented:

- 562 tankers (57%) of all vessels loading Russian oil in the last year

- Carrying roughly 2.3 Mbd (43%) of Russian exports

The lower share of cargo reflects that many Western vessels operate as flexible carriers, with Russian trade only part of their portfolio. Their lower utilisation in Russian routes means replacing them does not follow a simple one-for-one ratio.

Western vessels tend to enter the Russian market when prices fall below the cap, which was the case for much of this year. This makes them more prevalent during periods of weak Russian pricing.

Replacement Outlook and Shadow Fleet Growth

Replacing Western-covered vessels would disrupt the trade network supporting Russian exports. However, it remains highly likely that the system would adjust:

- Owners may switch to non-Western insurance or ownership structures.

- Non-Western vessels may increase utilisation.

- New or repurposed ships may join the Shadow Fleet.

- Some Western vessels may operate covertly

Historically, the Russian export system has proven able to manage periods of reduced Western involvement. For example, Western Suezmax and Aframax usage rose this year as crude prices dipped below the cap, while Western MR usage remained consistently high due to lower enforcement and regular sub-cap cargoes.

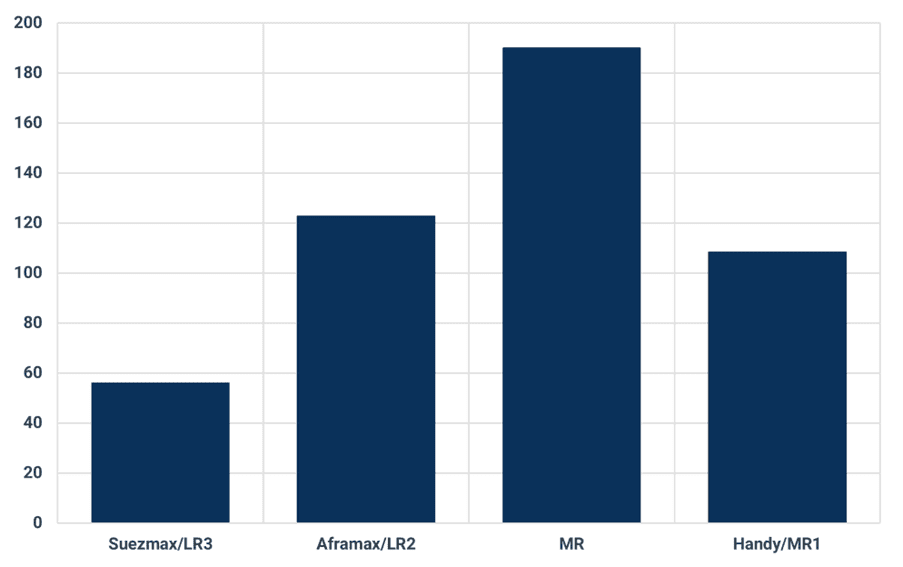

Shadow fleet growth required assuming full enforcement of Western services ban

Source: Kpler

Assuming full enforcement of a Western services ban, unchanged export volumes, and current Shadow Fleet productivity, we estimate the market would require:

- 56 additional Suezmaxes

- 122 Aframaxes

- 190 MRs

- 108 Handys

Although the actual replacement requirement is likely lower, thanks to an expected increase in productivity within the Shadow Fleet, a material increase in fleet size is still expected. This would likely be driven by higher Russian freight rates drawing more vessels into the trade.

However, Shadow Fleet utilisation is structurally constrained. These vessels are now dedicated almost exclusively to Russian flows and lack the commercial optionality needed to minimize ballast legs. A key feature of the appeal of the Russian market for Western vessels was a back haul opportunity. An example of this is picking up a Middle East crude cargo for the Mediterranean, after discharging in India.

In the MR segment in particular, Western-covered vessels currently show slightly higher utilisation, implying that replacing them could be closer to a one-for-one basis.

A larger, dedicated Shadow Fleet would be a significant shift in the current tanker market as more vessels than ever would be operating outside of the commercial market.

Enforcement Will Be Decisive

The effectiveness of any ban hinges on enforcement. Ownership structures and insurance coverage are often opaque, an issue encountered throughout our analysis, making monitoring difficult. Some operators may therefore choose to remain active in Russian trades despite restrictions.

The end to price caps would also mean Western vessels are unable to access the Russian market during period of below cap trading. This has acted as a source of additional demand to commercial vessels during period of weaker rates in the non-Russian market.

Want market insights you can actually trust?

Kpler delivers unbiased, expert-driven intelligence that helps you stay ahead of supply, demand, and market shifts. Our precise forecasting empowers smarter trading and risk management decisions.

Unbiased. Data-driven. Essential. Request access to Kpler today.

See why the most successful traders and shipping experts use Kpler