The future of Guinea's position in global bauxite trade and its alumina ambition

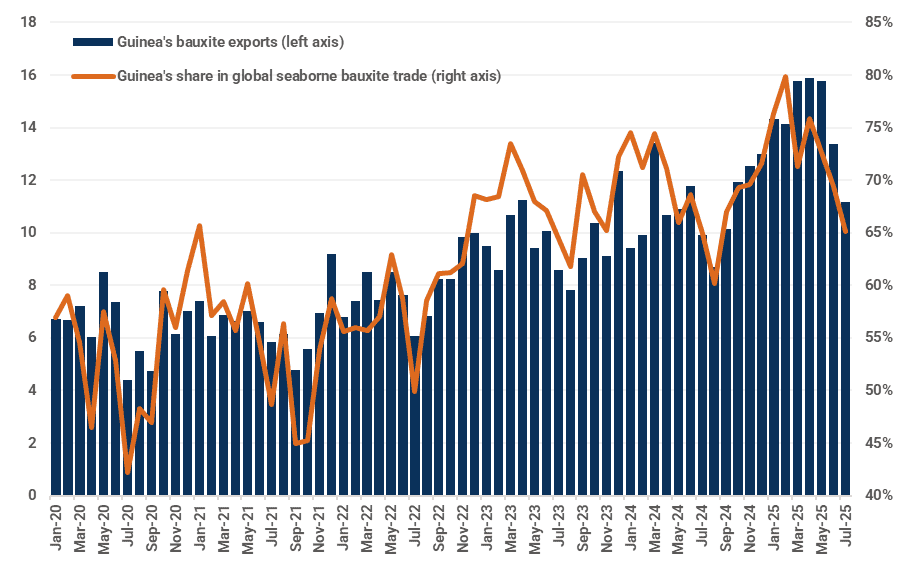

In the first seven months of 2025, Guinea accounted for 73% of global seaborne bauxite exports, consolidating its position as the dominant force in international bauxite trade. However, we have identified some headwinds that might shake Guinea's supremacy and hamper the country's ambition to build bauxite refining capacity.

- With new projects coming online and some expansion plans being put on the agenda elsewhere, Guinea's share in the global bauxite trade may peak soon.

- Resource nationalism, domestic politics, and the ramp-up of the Simandou iron ore may cap Guinea's export capacity.

- Guinea's alumina ambition might be hampered by infrastructure constraints, political and social stability concerns, and the global alumina oversupply.

Guinean bauxite exports and its share in global seaborne trade (Mt, %)

Source: Kpler

Will new capacity outside Guinea shake the country's dominant position in the bauxite trade?

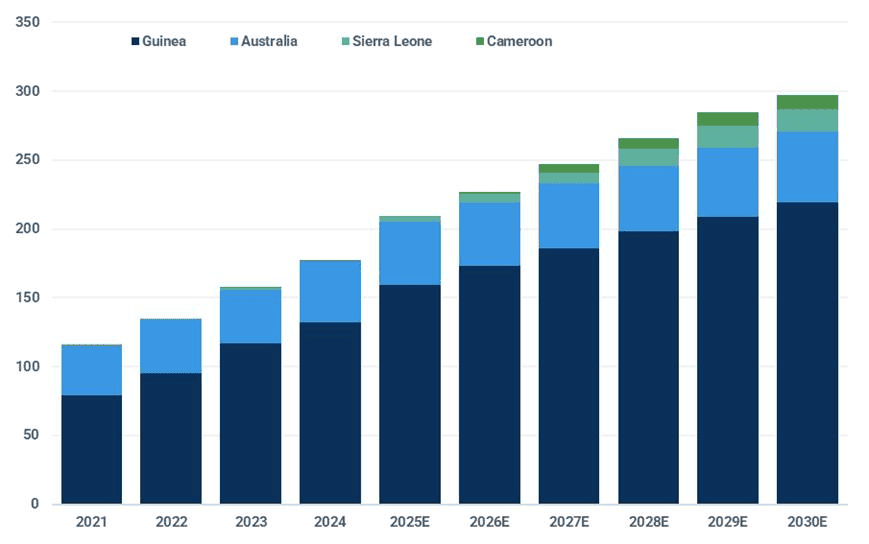

In Australia, sustained investment in production capacity and plateauing domestic demand will drive modest growth in bauxite exports in the coming years. Rio Tinto commenced work on the Norman Creek access project at the Amrun bauxite mine on Cape York Peninsula in Q3 2025, an integral component of the broader Weipa operation expansion. Concurrently, early works and a definitive feasibility study have commenced for the Kangwinan project, which is intended to replace the retiring Gove and Andoom mines. These initiatives could raise Rio Tinto's output in Australia by at least 7 Mtpa and reinforce long-term production stability.

Metro Mining, the second-largest bauxite producer in Australia, could increase its annual shipment capacity from the current 6.50-7 Mtpa to 8 Mtpa, contingent upon the alleviation of barging bottlenecks and the successful execution of its expansion strategy.

Collectively, these developments may lift the Australian bauxite exports to above the 50 Mtpa mark by the end of this decade and consolidate its position as the world's second-largest bauxite exporter in the long term.

In Sierra Leone, the completion of Maforki Port in May 2025 marks a milestone in the country's bauxite exports. Following this, bauxite departures from the country reached a record high of 0.54 Mt in July, and are expected to surge to 5 Mt in the whole of 2025 and over 7 Mt in 2026. The country's total bauxite export capacity is on course to reach 8 Mtpa in 2025/2026 and double to 16 Mtpa by 2026/27 through successive expansion phases.

Elsewhere in Western Africa, Cameroon is set to join the bauxite export landscape by Q1 2026. The country's first bauxite project, Minim Martap, developed by Canyon Resources, is expected to reach a production capacity of 6 Mtpa, with potential to scale up to 10 Mtpa in the longer term.

Heavy Chinese investments in the expansion of existing projects and new mines are expected to boost annual bauxite exports from Guinea to over 200 Mt in 2028/2029. Meanwhile, production expansion or new projects in Australia, Sierra Leone, Cameroon, and other emerging exporters such as Guyana and Ghana are anticipated to elevate the seaborne export capacity outside Guinea to over 90 Mtpa by 2029/2030, up from around 60 Mtpa in 2024. While these volumes are unlikely to displace Guinea's pre-eminent position in global trade, they may constrain its market share to around or below 70%, effectively curbing the potential for further dominance and diversifying global supply routes.

Annual seaborne bauxite exports by Guinea, Australia, Sierra Leone and Cameroon with forecasts (Mt)

Source: Kpler, Kpler Insight

Domestic headwinds that may cap Guinea's export capacity

Guinea's junta is doubling down on resource nationalism, recalibrating its bauxite policy to consolidate political capital ahead of the planned general election in December 2025. To fortify his image as a guardian of national resources, the country's leader has stepped up interventionist policies to extract greater value from the mining sector.

This has recently manifested in the revocation of licences held by key players, including Emirates Global Aluminium (EGA) 's local unit, GAC, and Axis Minerals. The vacated licences have been reallocated to operators deemed more beneficial to state interests, notably a newly minted state-run mining entity launched in August 2025. Such actions have heightened concerns over the stability and predictability of Guinea's investment climate, raising the risk premium for prospective foreign investors in the extractives sector.

Meanwhile, the imminent commissioning of the long-delayed Simandou iron ore project, slated for November 2025, could inadvertently pressure Guinea's bauxite industry. The higher export margins anticipated from Simandou's premium-grade iron ore will likely enable the project to offer more competitive remuneration, particularly for skilled labour, drawing talent away from bauxite operations. The exports of huge iron ore volumes may also create port congestion, slowing shipping operations.

Moreover, the government's expected windfall from iron ore revenues could significantly strengthen its leverage in negotiations with bauxite miners. This may embolden authorities to impose more aggressive measures to extract downstream commitments, particularly investments in domestic alumina refining, mirroring the recent suspension of EGA's operations over such demands. This assertive posture could mark a shift towards a more state-driven mining agenda.

Guinea's path to alumina refining proves steep and uncertain

Guinea's strategic goal of transitioning from a raw material exporter to a hub for value-added alumina production faces considerable hurdles, ranging from infrastructure shortfalls to global market dynamics.

1. Infrastructure Constraints

The absence of reliable infrastructure poses an immediate and fundamental barrier. In a country where even residential electricity supply remains unreliable, developing energy-intensive alumina refineries necessitates parallel investment in dedicated power generation. And the Guinean government sees these projects as more than just industrial ventures. It is leveraging alumina refinery development as a means to upgrade national infrastructure. In the case of China's State Power Investment Corporation (SPIC), its plan to build a 1.20 Mtpa alumina refinery accompanying a 250MW power plant, with 100MW asked to supply the national grid. And just like what has been observed during the construction of the Simandou project, investors may also have to commit to developing other supporting infrastructure, including roads and ports, from scratch, which compounds the capital intensity. These burdens make investment returns far from certain, discouraging all but the most risk-tolerant backers.

2. Political and Social Uncertainty

Investor caution is further amplified by Guinea's volatile political and social environment. With general elections scheduled for December 2025, apprehension over post-election stability has led to a deferment of major investment decisions. Escalating worker unrest and public protests in the lead-up to the vote, driven by demands for better wages and working conditions, underscore these concerns. The recent disruption at Rusal's Friguia alumina refinery exemplifies the volatility affecting existing operations, let alone new ventures.

3. Global Alumina Oversupply

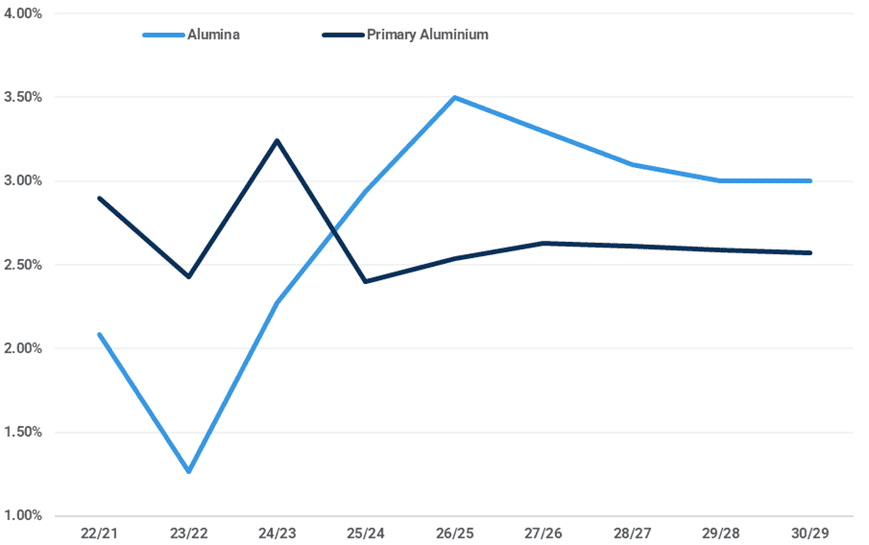

Compounding domestic risks is a challenging global market outlook. Between 2025 and 2027, over 30 Mtpa of new alumina capacity is set to come online in key regions, including China, Indonesia, and India, while additional capacity has also been proposed in countries like Ghana, Vietnam and the United States. With global alumina output growth expected to exceed primary aluminium production in the coming years, partially because China caps its primary aluminium capacity at 45 Mtpa but has yet to do a similar cap on its alumina capacity, oversupply pressures are mounting. This global imbalance could temper appetite for new projects in Guinea. Even if Guinea were to overcome its domestic challenges and the government compels bauxite producers to invest in refining capacity, whether that output will find viable export markets remains an open question.

Annual growth of global alumina and primary aluminium production with forecasts (Mt)

Source: IAI, Kpler Insight

New dry bulk insights

Gain instant clarity on dry bulk flows, rates and fundamentals with real-time AIS tracking and proprietary supply- demand models. Seasoned analysts deliver concise reports and live briefings spotting emerging trends and market imbalances. Navigate shifts with precision and confidence.

See why the most successful traders and shipping experts use Kpler