US copper tariffs - near-term covered, no self-sufficiency before 2035

US copper demand could potentially be satisfied for most of H2 2025 using the existing inventories built during the massive influx during H1.

- Tariff-driven price surge: The announcement of a 50% U.S. tariff on refined copper imports triggered a spike in Comex prices and widened the Comex-LME spread, reflecting initial market expectations of a lower eventual levy (~25%).

- Short-term import front-loading: Ahead of the expected tariff implementation, U.S. seaborne copper imports surged, particularly from Peru and Chile, with ytd volumes already nearing full-year 2024 levels; inventories may be sufficient to meet most H2 2025 demand.

- Self-sufficiency unlikely before 2035: Long permitting timelines, limited smelting capacity, and rising copper demand from electrification and data centers mean the U.S. cannot become self-sufficient in copper before the next decade—even with major projects like Resolution Mine.

On June 8, a 50% tariff on U.S. refined copper imports was announced, coming into effect on August 1. In response, Comex prices soared to a record high of more than $5.50/lb, driving the premium against the LME benchmark from 11% to more than 26% within one day. In anticipation of U.S. trade barriers, the Comex premium had already spiked to 17% and 16% in March and April, respectively. A rush to ship copper to the U.S. pushed LME inventories to a 2-year low, while Comex stocks rose to a 7-year high.

Based on the Comex premium right now, markets appear to be pricing in a 25% levy eventually. On the other hand, a 50% tariff would require a further widening of the Comex-LME spread to keep attracting cargoes to the U.S. (see below).

Short-term implications

Up until the tariff deadline, a hike in U.S. seaborne imports from Peru and Chile is likely, as the 2-to-3-week voyage would still allow vessels currently loading to arrive ahead of the deadline. However, vessels currently lined up to load refined copper from more distant locations such as South Africa and Australia are set for diversion away from the U.S., toward Europe and China, where stock levels have fallen significantly since early March.

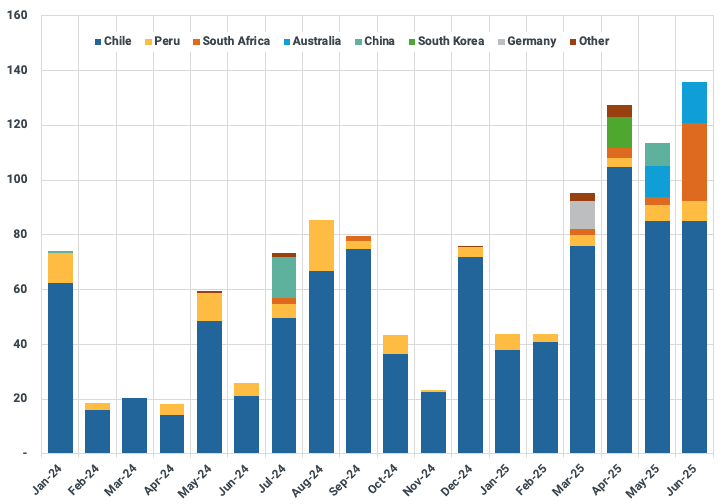

While manufacturers could seek to defer copper consumption in the face of tariffs, an immediate threat to U.S. copper availability is unlikely. The U.S. relies on imports for 45% of its copper consumption, which equates to 810 kt of refined copper imports (Kpler calculations based on 2024 U.S. Geological Survey data), 598 kt of which arrived seaborne on bulk carriers last year. Our data shows that, in anticipation of tariffs, U.S. seaborne imports have more than doubled to well above 100 kt/month since April (see chart). As a result, the U.S. has already imported 568 kt of seaborne refined copper in 2025 ytd, approaching full-year 2024 levels (598 kt). For H1 2025, that corresponds to a 158% increase y/y (+343 kt). Between January and May 2025, US imports from Canada and Mexico, rose as well on the year, however, at a comparatively modest 19% (+12 kt). Overall, U.S. copper demand could potentially be satisfied for most of H2 2025 using the existing inventories built during the massive influx during H1.

US seaborne imports of refined copper by origin (kt)

Source: Kpler

Longer-term implications

For most of its applications, copper is notoriously difficult to substitute, making demand relatively inelastic. Nevertheless, U.S. consumption could come under pressure amid record Comex prices, and additional downside to U.S. imports will depend on the actual tariff level relative to the U.S. price premium (Comex) versus the LME:

- The Comex premium currently stands at 26%. When combined with a 50% tariff, imports are expected to decline, as imported copper—typically purchased based on LME 3M pricing on which the tariff is applied upon entry—would become even more expensive than Comex-priced U.S. supplies.

- Conversely, if the tariff rate and the Comex-LME premium were to align at, for example, 50%, inflows would likely continue—albeit potentially at reduced levels due to demand destruction.

Under which circumstances could the U.S. become self-sufficient in copper?

As of now, the U.S. processes approximately half of its mined copper supply domestically, with the remainder being exported. U.S. smelting capacity therefore constitutes the more immediate bottleneck. Setting up a copper smelter from scratch typically takes a minimum of 5 years, while the time horizon for bringing a greenfield mine online can easily exceed 10 years. Should the U.S. government intend to create a price environment to promote domestic copper production, tariffs would likely need to remain in place long term, unless we see a similar and sustained increase in global prices.

Scenario: Assuming a massive ramp-up in U.S. smelting capacity and full domestic processing of copper ores currently mined in the U.S., import reliance on refined copper would fall from 810 kt (45%) to 257 kt (14%; based on 2024 demand figures). The Resolution Copper Mine project (55% Rio Tinto, 45% BHP) in Arizona could supply 450 kt annually, according to company information, around a quarter of U.S. demand. In late May 2025, the U.S. Supreme Court cleared the way for the mine, however, a decade of construction now lies ahead. Further assuming a simultaneous increase in U.S. smelting capacity to process all Resolution output of copper concentrate, the shortfall could turn into a surplus of 193 kt.

However, these scenarios are based on 2024 demand figures and U.S. copper demand is set to surge driven by electrification and the construction of data centers. As a rule of thumb, 1 MW of data center capacity requires around 27 tons of copper. Overall, the U.S. would likely need additional copper mines and smelters beyond the existing project pipeline to become self-sufficient—and even then, self-sufficiency would not be achievable before the next decade.

Want market insights you can actually trust?

Kpler delivers unbiased, expert-driven intelligence that helps you stay ahead of supply, demand, and market shifts. Our precise forecasting empowers smarter trading and risk management decisions - backed by the most accurate oil price predictions two years running.

Unbiased. Data-driven. Essential. Request access to Kpler today.

See why the most successful traders and shipping experts use Kpler